Dear Mike and Bruce,

Nice going guys. Illinois has been without a budget since the second half of 2015. The longest in state history. And the longer it goes on, the more it will cost to fix. That’s because with 90 percent of budget spending automatic, there is only 10 percent left to negotiate (including all of the higher education budget).

Funny how those less well-off are screwed by both of you. Directly screwed by you, Bruce, who refuses to agree on a budget before ramming your pro-business, anti-worker structural reforms down our throats. If you showed up at a corporate board meeting and presented an economic balance sheet like that of Illinois and lack of progress since you have been in charge, you would be fired on the spot. And what about you, Mike? The champion of labor, of the poor and disadvantaged, all of whom you have and continue to sacrifice as so many pawns.

So, thanks to both of you for showing that, indeed, budgeting and tax policy are not economic issues – driven by the “dismal science” – so much as political, and social issues. This is an important reminder. Tax policy and the budget are as much, if not more, political statements about what kind of society we want, than they are straightforward, “objective” economic documents.

Now, here’s an idea. Focus on the economics, not the politics, of the budget. You know, the facts necessary to make evidence-based policy decisions. To do so, look at data compiled by the Illinois bi-partisan, non-profit Center for Tax and Budget Accountability.

Can we do that, please? Because when we do, we see that the budget economics are not rocket science. Presented with the facts, the voters, the citizens of Illinois can easily see what both of you are not doing.

Best wishes,

–David

Top Seven Myths About Illinois’ State Budget:

1: “Illinois is a High Spending State”

Not true.

Illinois is a low spending state compared to the rest of the U.S. It ranked 28th in General Fund spending on services per capita, and 36th in General Fund spending on services as a share of GDP in FY2012, the most recent year for which there is nationally comparable data.

Yet Illinois is a rich state. Its Gross Domestic Product (GDP) is the fifth highest in the US, and its GDP per capita is the 12th highest. Illinois’ economy is the 20th largest in the world, bigger than that of Egypt, Colombia, Belgium, Sweden, Greece, Ireland, Portugal, Norway and Nigeria.

Therefore, it is simply false to argue that Illinois’ budget problems are driven by overspending. In fact, the opposite is true.

2: “Illinois Needs to Cut Spending to Balance its Budget”

In fact, it already has, but both Democratic and Republican politicians confuse people.

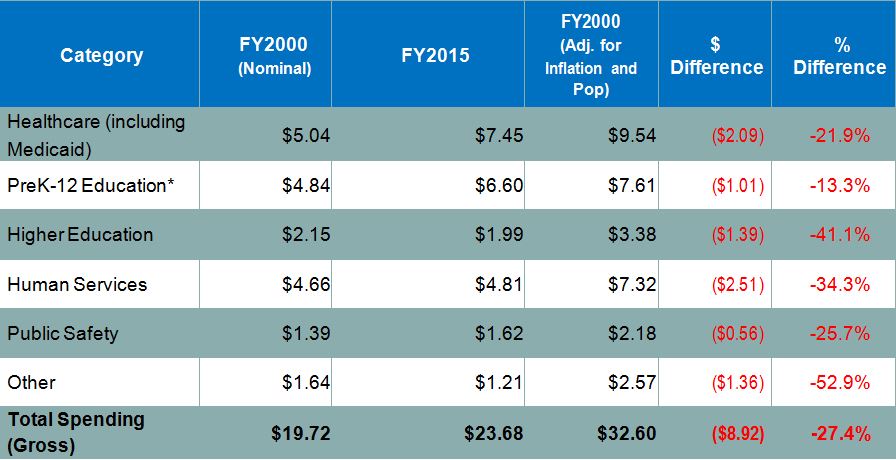

Between FY2000 and FY2015 General Fund appropriations increased 19.1 percent in nominal dollars for the four core service areas of education, healthcare, social services, and public safety. But when adjusted for inflation and population growth, these appropriations decreased in real terms 27.4 percent (Senate Revenue Hearing, slide 15).

Therefore, spending is not the problem. And spending less has not fixed the problem. Instead, the problem is a structural deficit (see below).

3: “Illinois Needs to Shrink Government by Cutting State Workers”

Illinois is already next to last in the nation.

It ranked 49th in the U.S. in the number of state workers per 1,000 residents in 2011, the most recent year for which comparative data exists.

No, the number of public sector state employees is not driving the budget problem.

4: “Illinois Needs to Reduce Pension Debt By Cutting Pension Benefits”

Overly-generous pension benefits are not the cause of the pension debt.

Illinois tried to cut benefits despite the plain language of the state constitution that states that retirement benefits cannot be “diminished or impaired.” And failed in court.

No, outsized benefits are not the cause of the pension debt. The cause is that Illinois has underfunded pensions over the last 25 years, under both Democrats and Republicans. Worse, Illinois borrowed from the pension systems to fund current services instead of modernizing its tax policy. Let us be clear: Illinois has borrowed from Peter – the pension systems – to pay Paul’s costs – of funding state services.

As if this was not bad enough, the repayment plan for that debt was “backloaded,” that is, annual payments increase each year. The “pension ramp” created thereby is unsustainable: Illinois will never have enough money to pay the costs ramped-up over time.

5: “Illinois is a High Tax State”

Wrong.

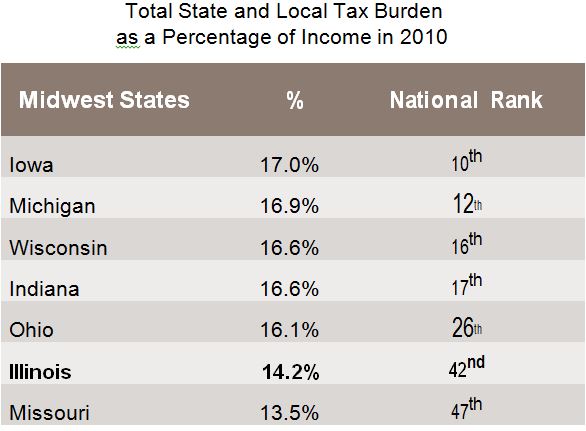

As a percentage of personal income, Illinois’ total state and local tax burden usually ranks in the bottom 10 nationally. Of seven Midwest states, Illinois’ tax burden is next to last; only Missouri’s is lower (Senate Revenue Hearing, slide 20).

The good news is that because the tax burden is relatively low, Illinois can increase taxes and still remain a low tax state.

6: “Illinois Corporate Taxes are Too High and Driving Business Away”

Not true.

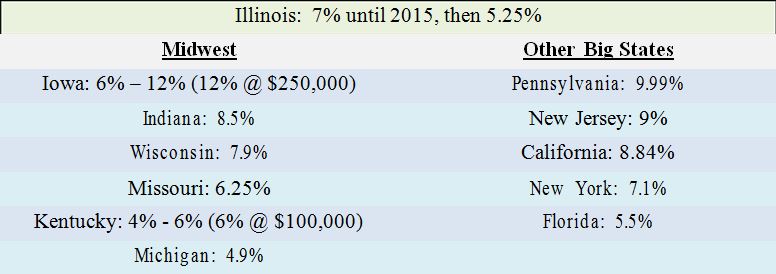

In 2010, before the tax rate was temporarily lowered from seven percent to 5.25 percent, almost 70 percent of corporations paid no tax, and nearly 93 percent paid $5000 or less (Senate Revenue Hearing, slide 23).

Rauner and his business buddies like to complain about Illinois corporate taxes. What they do not say is that the corporate tax is a tax on big businesses – the vast majority of businesses pay little or no tax at all.

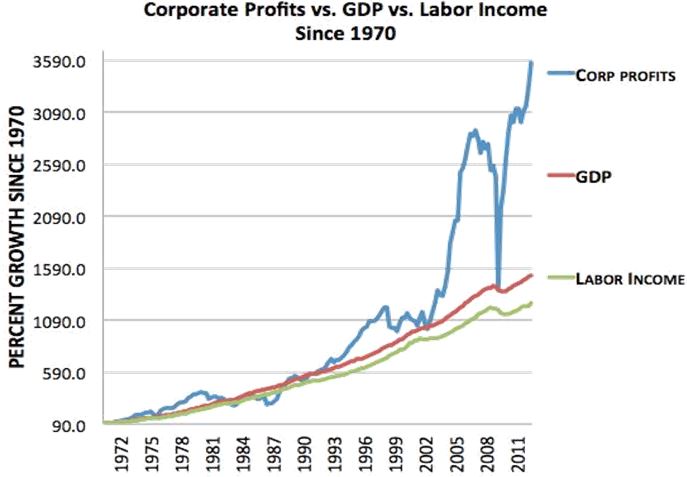

Nor do Rauner & Company willingly admit that corporate profits are at an all-time high in supposedly “business-unfriendly” Illinois.

Using 1970 as a baseline, neither labor income nor GDP has kept pace with increased corporate profits for the 40 years through 2011 (Senate Revenue Hearing, slide 26). Particularly striking is the spike in profits before and after the 2008 Great Recession.

7: “Illinois Needs to Cut Taxes on the Wealthy To Trickle-Down Money to Spur the Economy”

In effect, this is what Illinois did in rolling back the temporary 2011-2014 tax increase from five percent to 3.75 percent.

But the top 40 percent income earners received nearly 87 percent of the resulting tax relief. Meanwhile, the bottom 60 percent of income earners in Illinois—who have experienced real loss in wages over the last 30 years—receive just 13.2 percent, or $491 million of the $3.7 billion in total tax breaks provided by the phase-down.

(lllinois State & Local Taxes Paid as a Share of Family Income for Non-Elderly Taxpayers, Senate Revenue Hearing, slide 12)

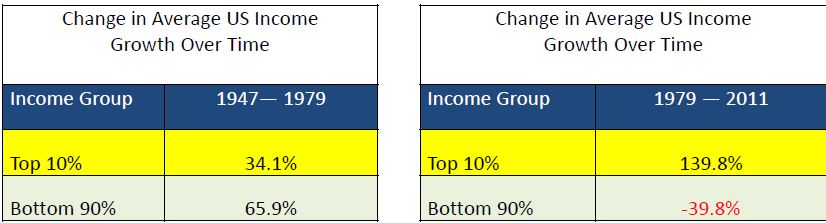

The context here is increasing income inequality in both the state and nation. It is the bottom 60 percent who have experienced real loss in wages over the last 30 years.

(Increasing Income Inequality, 1947-1979 vs 1979-2011, Senate Revenue Hearing, slide 13)

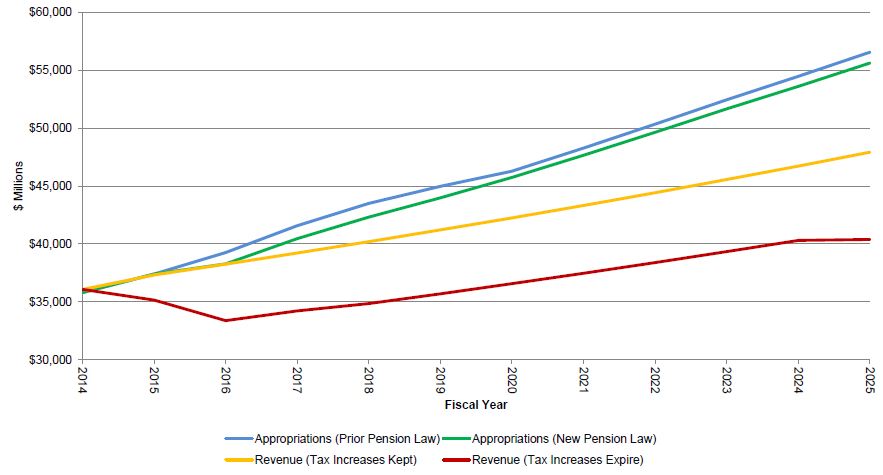

The rollback in the personal income tax means that tax revenue will decrease from $36.7 to an estimated $32.1 billion in 2016. This constitutes the “fiscal cliff” Illinois is racing towards.

It is worth emphasizing that the Illinois state constitution mandates that the personal income tax be a flat tax – everyone is assessed at the same percentage rate – which by definition makes it a regressive tax – the richer you are, the less you pay as a percentage of income.

The rollback in the personal income tax is also occurring at a time of record corporate profits, as documented above.

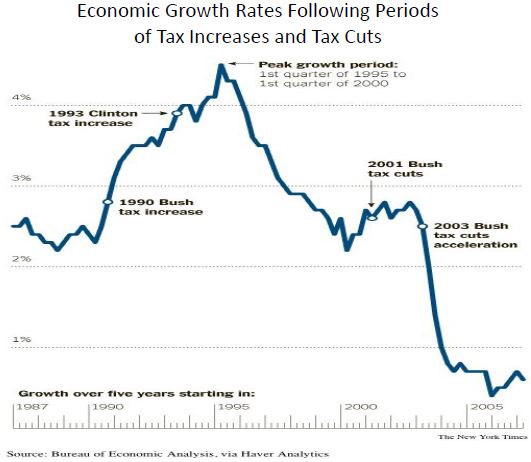

The argument in favor of decreasing taxes on the wealthy is that it stimulates the economy. This is one of the pillars of “supply-side” or “trickle-down” economics, one of whose proponents is Arthur Laffer, known for the “Laffer curve.” In 1980 George H. W. Bush accurately termed “Reaganomics” as “voodoo economics.”

It is not only counter-intuitive, but flat-out, empirically wrong. As Nobel-prize-winning economist Paul Krugman puts it, “The classic zombie idea in U.S. political discourse is the notion that tax cuts for the wealthy pay for themselves.” Krugman defines a zombie idea as “a proposition that has been thoroughly refuted by analysis and evidence, and should be dead — but won’t stay dead because it serves a political purpose, appeals to prejudices, or both.”

(Senate Revenue Hearing, slide 41)

Rauner hired a Laffer acolyte as his economic advisor at a salary of $30,000 per month. Every leading Republican presidential contender embraces this “supply-side,” “trickle-down” nonsense.

Giving a tax cut to millionaires — which is what rolling back the state income tax rate amounted to — provides no material stimulus to the economy, and actually worsens income inequality in Illinois. Instead, Illinois should be cutting taxes on the less-wealthy to stimulate the economy.

This is because of the “marginal propensity to consume” (MPC). Families with less income have a higher MPC than wealthier families. Generally, those with fewer resources have unmet material needs, so for every additional dollar of income, they tend to spend a higher proportion of that additional dollar than a high-income household. In contrast, a high-income household already has sufficient income and have already purchased their necessities, so that with each additional dollar they are more likely sock it away rather than spend it.

Given that consumer spending accounts for 70 percent of all economic activity, cutting taxes on the less well-off is what stimulates the economy.

What is To Be Done?

1) The cause of the budget problem is the structural deficit in the general fund due to the tax system

The “structural deficit” is the ongoing gap between the cost of maintaining current services, and tax revenue.

(Going Forward: Illinois Still Has a Structural Deficit, Senate Revenue Hearing, slide 32)

Instead of revising its outdated tax policy to generate more revenue, Illinois politicians, both Democratic and Republican, have chosen for decades to take a “pension holiday,” and borrow from what it owes the pension systems to subsidize the cost of current services not covered by current taxes.

If you are in a hole, stop digging deeper. Yet to pay back the pension systems, Illinois created the “pension ramp,” a repayment schedule that increases annual payments over time to unaffordably high levels.

2) Reform tax policy to generate more revenue

The structural deficit results, in turn, from poor tax policy.

That is the bad news. The good news is that there are a number of ways to raise revenue. And still keep Illinois a relatively low tax state.

a) Reform sales tax policy by expanding the base of the sales tax to include most consumer services

Illinois’ tax code is woefully out of date and needs to be revised.

First, some background. Illinois’s sales tax rate for most goods is 5 percent. However, the state sales tax rate is usually identified as 6.25 percent. This is because, in 1990, the state rate of 5 percent was combined with a local sales tax rate of 1.25 percent. Thus, the 6.25 percent sales tax rate is actually made up of a 5 percent state sales tax rate and a 1.25 percent standard local government sales tax rate. Note that Illinois’ state sales tax rate of 5 percent is below the national average of 5.5 percent.

The purpose of taxes, including sales taxes, is, of course, to generate stable revenue for the state. For a sales tax to do this, it needs to apply to most transactions in the consumer economy. Now, consumer spending both nationally and in Illinois accounts for nearly 70 percent of all economic activity. Moreover, consumer spending usually does not decline substantially, even during major economic downturns, such as the 2007-2010 Great Recession. If a sales tax base applies to most consumer transactions, therefore, that sales tax will provide some stability to a state’s fiscal system.

The problem is that in Illinois this is not the case.

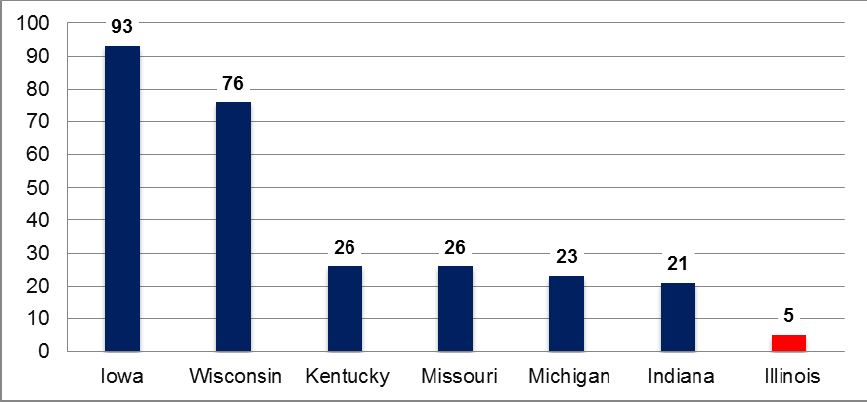

The “base” of a sales tax is simply the basket of items and services that the tax applies to. But Illinois generally taxes goods (such as clothing and furniture), but not services (pet grooming, health clubs, lawn care, and the like). The general sales tax applies only to five of the 168 generally recognized service industry categories. Among the 45 states that levy a sales tax on services, including Illinois, the average number of service industries taxed is 51. Among these states, Illinois ranks dead last in the number of service industries subject to its general sales tax.

(Number of Service Industries Taxed under General Sales Tax, Senate Revenue Hearing, slide 34)

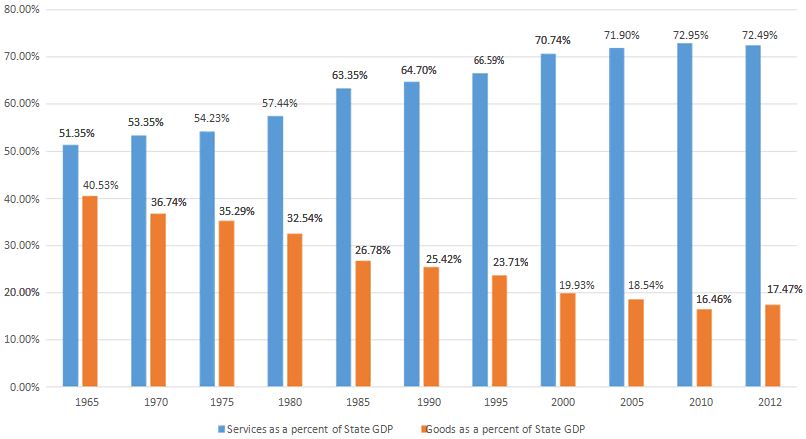

By excluding most services from its sales tax base, therefore, Illinois is shooting itself in the foot, and making the achievement of fiscal health difficult. For it has created a fiscal mismatch between the really existing state economy, and that portion of the economy taxed to fund public services. On the one hand, the sale of goods as a percentage of GDP declined between 1965 and 2012 from under 41 percent to under 18 percent. On the other hand, the sale of services increased from over 51 percent to over 72 percent (Senate Revenue Hearing, slide 33).

The bottom line is that even as the Illinois economy changes – and grows – the state collects less and less in inflation-adjusted dollars. Measured as a share of the state economy, the sales tax base has lost more than half of its value in the last 45 years.

b) Increase the personal income tax rate from 3.75 percent to 4.75 percent or 5 percent

The temporary personal income rate of five percent 2011-2014 fell back to 3.75 percent beginning this year.

As discussed above, by rescinding the temporary tax increase, Illinois began racing towards a “fiscal cliff” due to the resulting loss of revenue from $36.7 to an estimated $32.1 billion in 2016. This economic reality is why all the politicians realize that as part of the resolution to the current budget stalemate, there will have to be a tax increase — even Governor Bruce is on record as acknowledging this.

It is necessary, therefore, to raise the personal income tax rate to 4.75 or 5 percent. Note that even at a five percent rate Illinois would be a comparatively low-tax state, as we saw above (Myth #5).

c) Tax some retirement income

Of 41 states with a personal income tax, Illinois is one of only five that does not tax retirement income. Yet roughly 18 percent of the state’s population will be of retirement age by 2030, which makes for an overly broad exclusion.

This contributes to making Illinois one of the five most unfair taxing states in the country.

Therefore, tax retirement income, but phase it in gradually from $50,000 adjusted gross income (AGI), so that no low income senior is harmed. Under such an approach, any taxpayer with an AGI under $50,000 would keep the full deduction, and pay no state income tax on retirement income.

d) Increase the corporate income tax rate from 5.25 percent to 6 percent

Recall that despite Rauner Republican rhetoric, most businesses do not pay any tax at all.

At either 5.25 or 6 percent, Illinois would still be low relative to other states – 6 percent would be in the mid-range.

e) Eliminate corporate tax expenditures that do not generate a public good or stimulate the economy

Some corporate tax expenditures do generally produce a public good or service, such as underwriting research and development. Others, however, do not, and should be eliminated. This is the case all-too-often with tax expenditures to stimulate job creation.

f) Impose a Tax on sugary sweetened beverages

This is a no-brainer.

Given out-of-control obesity rates, and Illinois’s current tax code, good health policy and good tax policy both mandate such a tax. Killing two birds with one stone is a win-win.

3) Re-Amortize the Pension Debt

The second major requirement for eliminating the structural deficit is to re-amortize Illinois’ pension debt.

Re-amortization simply means changing the annual repayment schedule for the pension debt Illinois already owes. Get rid of the backloaded, unsustainable “pension ramp” repayment plan. Repay the same amount over an increased number of years, just like a traditional, fixed-rate mortgage.

Illinois can resolve its unfunded liability, grow its funded ratio, meet all system cash flow obligations to pay retirement benefits, and free up substantial current revenue to fund current services by utilizing a level dollar annual repayment of its pension debt of approximately $7.014 billion.

Conclusion: An Economically-Viable, Fact-Based Budget Turnaround

(Senate Revenue Hearing, slide 39)

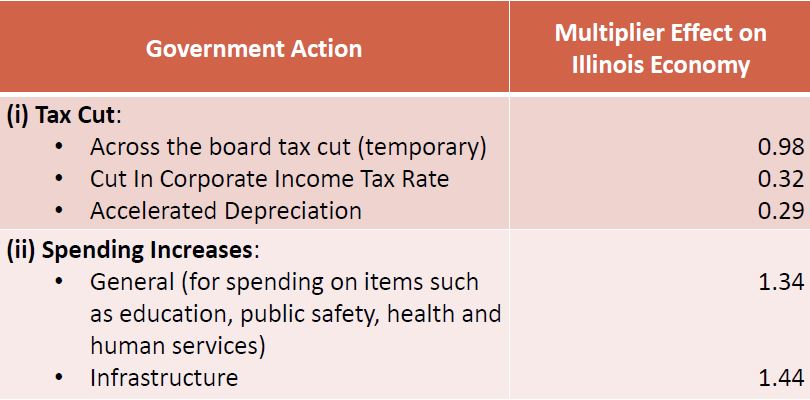

If Illinois were to increase income taxes to 4.75 percent, tax some retirement income, expand the sales tax base to include most consumer services, eliminate the tax expenditures noted above, and impose a new tax on sugary beverages, the state would raise over $7.9 billion in new revenue in FY2016.

(Increasing Taxes the Right Way: For Every Dollar Spent the Resulting Multiplier Effect, Senate Revenue Hearing, slide 40)

Budget problem solved, economically. The only think lacking is the political will to do it.

David Prochaska formerly taught colonialism and visual culture in the UI History Department