Financial transaction taxes (FTT) are an innovative system whose time has come again. There has been a narrow FTT in the UK since 1694, which raised $4.9 billion in 2020, and it hasn’t prevented the City of London from being a financial center second only to New York City. It’s not covered much in the corporate media; of course, the business press is full of critiques. Right-wing think tanks are busy peddling extreme Chicken Little scenarios if the tax were to be implemented. But raising the issue of media criticism of economic issues without reference to the current misrepresentation of the inflation cycle we are in isn’t possible for this author.

Briefly, inflation is a tax on the working class. However, the extra cost is not being taken into government coffers.

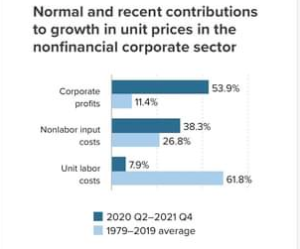

This particular time period is unique in that much of the price rise is due to corporate profits. Josh Bivens of the Economic Policy Institute (EPI) has documented the astonishing extent of the phenomenon that can be laid on corporate greed. He has not found a period of inflation that comes close to the reality illustrated in the graphic below. Rising labor costs are the least of the problem.

Author’s analysis of data from Table 115 from the National Income and Product Account (NPA) of the Bureau of Economic Analysis (BEA). Care of Economic Policy Institute

Despite this, Jerome Powell of the Federal Reserve System (the Fed) has asserted that one of the goals of his policy is to restrain wage growth.

One hears some about price gouging, but its extent is truly extreme. Bivens and others suggest a windfall profit tax similar to those passed during wartime, when opportunists used drastic circumstances to scalp the public. In the UK, Prime Minister Boris Johnson’s Conservative Party has actually implemented a windfall profits tax.

Returning to the FTT, Senator Bernie Sanders suggested a tax on stock sales whose revenues would be dedicated to higher education for all. This was at the beginning of the Biden term, when a few new ideas were floated.

James Tobin, a Nobel Laureate and neo-Keynesian economist, is strongly associated with the concept of a transaction tax. (An aside: he was born in Champaign.) He suggested a small tax on each purchase on the international currency market to mediate the volatility in the world economy. The concept has been broadened to include a wide variety of financial instruments, and indeed there is more widespread chaos across the spectrum, e.g., high-speed trading by algorithm. For instance, Berkshire Hathaway stock crashed for an interval when actress Anne Hathaway, who has nothing to do with the company, had an auto accident—an absurd non sequitur generated by algorithmic trading.

Dean Baker of the Center for Economic and Policy Research (CEPR) is an essential watchdog of the business press. His column “Beat the Press” critiques the New York Times and Wall Street Journal’s coverage of economic issues. His major book, Rigged: How Globalization and the Rules of the Modern Economy Were Structured to Make the Rich Richer, is now available for free online.

Baker did a major study of the transaction tax and its effects if implemented. His conclusion was that the FTT would have the effect of the progressive targeting of the wealthy and the beneficial slowing of trading. He was concerned that the Trump tax cuts would not be rolled back as was promised in the Biden campaign, and was looking for a substitute to generate revenue. He was right: recall that the tax cuts were only rolled back 50 percent. So the trickle-down theory reigned. However, this was only a fig leaf of justification. In reality, corporate powers had to be mollified as campaign coffers needed to be filled.

Baker has also suggested that a transaction tax on Bitcoin might be politically advantageous to introduce the financial transaction concept on a big stage. It would bring this supposedly autonomous currency into the economy and perhaps lessen some of its volatility.

Professor James Henry is at the Tax Justice Network (TJN) and the Global Justice Program at Yale. He worked at the Kinsey consulting group that has had its hands in projects around the world, some nefarious, for example its consulting work for the Saudi dictator. So he knows the belly of the beast. His 2003 book is The Blood Bankers: Tales from the Global Underground Economy. Another important project that Henry works on with TJN is financial transparency. They have just issued their biannual report, which found that overall the US is now the least transparent country, and the greatest offender regarding the volume of hidden money. This is despite the fact that legislation has been passed that follows the guidelines of the G20 and the European Union regarding transparency. The problem is that the administrative law that enables this legislation has not been worked out, so in the meantime states have had a growth industry in tax evasion. There’s a peculiar anecdote of the Trump era early in 2017. Trump attended a G20 meeting where somehow they agreed to transparency guidelines. This was probably because they were busy juggling the dictated memo that Trump wrote for his son Don Jr. regarding his connection to some oligarchs. Upon returning to DC, Trump realized what they had done, and considering that he is known as the launderer-in-chief, rescinded the commitment. This relates to the financial transaction tax in that some of this hidden money could possibly be taxed.

Professor Henry is involved in politics in New York State, and along with colleagues prepared a document in favor of the transaction tax, available at the TJN website. A great irony is that there has been a transaction tax on the books since 1905, legislated by the Albany, NY Republicans. Of course, there was also the Bull Moose Party of Teddy Roosevelt in the whole trust-busting era, which grew out of revulsion at the Gilded Age and the conspicuous consumption of the mega-rich, a phenomenon with echoes to this day. Over the period of its many decades of use, it collected $300 billion in 2020 value. In 1981, Democratic Governor Hugh Carey gave in to pressure from Wall Street and rebated the tax revenues. This continues up to today; estimates are that over the last decade the political elite in New York State has foregone roughly $8 billion due to the state. Governor Andrew Cuomo, who left in disgrace, was not in favor of the transaction tax, to put it mildly; and the current governor, Kathy Hochul, who was a lobbyist for banking interests, is no fan either. The attempt to revitalize it has not been successful in New York State, and you’re probably reading about it for the first time right here. Again, it takes an astonishingly disciplined business press and media in general to ignore this issue when there are social needs in New York and elsewhere which could be funded in this very progressive way and aren’t.

The document referred to above, Submission to New York State Assembly: the Case for Financial Transactions Taxes, by James S. Henry, John Christensen, David Hillman, and Nicholas Shaxson, is well worth your consideration. It collects the arguments for and shoots down the many myths about financial transaction taxes. It explains the failure of the Swedish version. It concludes, as I will here, in listing the various countries that have an FTT.

In fact, FTTs of different kinds are happily in place in Belgium, China, Colombia, Cyprus, Egypt, Finland, France, Hong Kong, India, Ireland, Italy, Kenya, Malaysia, Malta, Pakistan, Peru, Philippines, Singapore, South Africa, South Korea, Spain, Switzerland, Taiwan, Tanzania, Thailand, Trinidad and Tobago, Turkey, the United Kingdom, and Venezuela—and those are just the ones we know about. Denmark and Poland are considering them.

472 total views, 1 views today